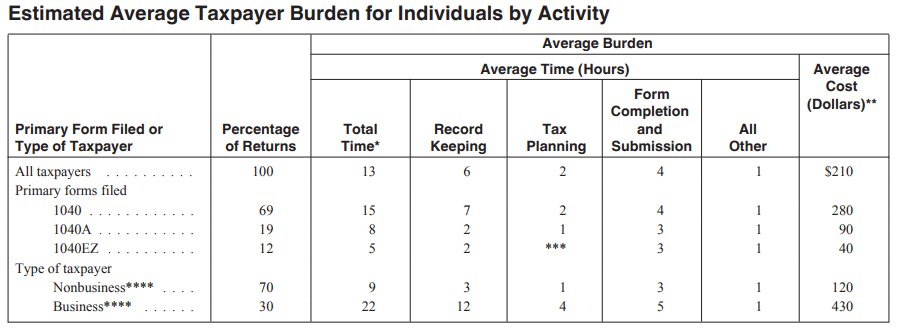

It can take a considerable amount of time to actually prepare and file a tax return. The IRS puts the time and cost at 13 hours and $210 dollars for the average income tax return. The numbers jump to 22 hours and $430 for the average business income tax return. Luckily, many taxpayers are not even required to prepare or file a tax return. So who is required to do so?

Persons required to file tax returns

There are a number of persons who are required to file tax returns. This includes:

- Individuals who live in the U.S. and all U.S. citizens wherever they live if their income exceeds certain limits, which is discussed below.

- Corporations or Subchapter S corporations are subject to income tax regardless of whether the return shows a tax due or a loss.

- Trustees and other fiduciaries of trusts and estates.

- Those who employ or pay amounts subject to withholding tax.

- Those who have a manufacturer or retailer excise tax, environmental excise tax, indoor tanning service tax, foreign insurance policy excise tax, and other insurance excise taxes.

- Domestic international sales corporations.

- Those who have a financial interest or control over a foreign financial account.

- Those who participate in reportable transactions must be disclosed to the IRS.

- Those who make gifts in excess of the annual dollar amount exclusion.

- An estate of a person who passes away if the gross estate exceeds the basic exclusion amount reduced by the decedent’s adjusted taxable gifts.

- An estate for nonresident aliens who had assets located in the U.S.

Individuals who have to file income tax returns

As mentioned above, individuals who live in the U.S. and individuals who are U.S. citizens have to file income tax returns if their income exceeds certain limits. The income limits vary based on the years involved and the taxpayers filing status and age.

For more recent years, those who file as single and are under age 65 must file an income tax return if they receive $1,750 of gross income or $2,500 if they are 65 or over. These numbers jump to $2,500 and $3,250 for married taxpayers. There are nuances of course. These additional rules are spelled out in Treas. Reg. § 1.6012-1(a).

This is the technically correct answer.

What are the consequences for those who do not file

There are a number of consequences that come from not filing tax returns, including tax penalties, missed tax elections, and not starting the IRS’s audit and assessment period.

Tax Penalties

Penalties are the most often cited reason for timely filing tax returns. These penalties can include criminal penalties and civil tax penalties, such as the failure to file and, if applicable, the failure to pay penalties.

The civil tax penalties are computed based on the tax that is due on the return. So if no tax is due, then the penalties do not apply. This is the case even if the taxpayer received gross receipts in an amount that would require a tax return filing requirement.

This is why many tax return preparers do not recommend filing income tax returns unless the amount of income would exceed the standard deduction plus the personal exemption allowable to the taxpayer for the year, even though the rules technically require a tax return filing.

It should be noted that this only applies to individual taxpayers and income tax returns. It should also be noted that penalties are not the only fact that should be considered.

Tax Elections

Tax elections also have to be considered when deciding whether to file a tax return. These elections are statements included with returns that tell the IRS that the taxpayer intends to apply some rule or treat an item in a certain way. There are a number of tax elections that have to be made on timely-filed original tax returns. The election to amortize start-up costs is one example. These elections cannot be made a later time. By not filing timely returns, the taxpayer may miss out on these opportunities.

IRS Audit and Assessment Time Periods

The same goes for starting the time the IRS has to audit and assess additional tax for the year. This is usually three years from the time the tax return is filed. These time periods do not begin to run if a tax return is not filed. This can be a good reason to file returns even when there is no tax return filing penalty or where there is no tax due.